The Inception of Digital Rupee

India's new Digital Currency's pilot program is here.

Introduction

Did you hear about the new Digital Rupee pilot program flagged off by the Government of India? Initially proposed in the 2022 Union budget, it has been released for a closed user group for now but will eventually be rolled out for the general public. This currency makes completely digital transactions possible, powered by blockchain technology.

Governments worldwide have hesitated to embrace public cryptocurrencies because of apparent concerns about law and order. Still, some economies also fear that cryptocurrencies will undermine traditional financial systems and the role of central banks. CBDCs are a possible solution to these concerns.

Central Bank Digital Currency

Central bank digital currency (CBDC) is a digital version of a country's fiat currency issued and backed by its central bank. CBDC aims to provide a secure and efficient way for the central bank to issue, distribute, and track digital currency while giving consumers an alternative to traditional physical cash. One potential benefit of CBDC is that it could make it easier for the central bank to implement monetary policies, as it would have greater control over the supply and demand of digital currency.

Close to 105 countries are exploring digital currencies. Fifty of these countries, including India, are in various phases of adoption, and 11 have already launched a digital currency following successful pilot projects. The Bahamas was the first to launch a digital currency officially, followed by Nigeria and the Eastern Caribbean Union. India, UAE, Ghana, South Africa, Malaysia, Singapore, and Thailand have also launched their pilot program.

The Digital Rupee in India

To understand the digital rupee, answer this question: Where would you keep your money if you did not have a bank account and wanted to avoid keeping that money in a physical safe somewhere? This is where the digital rupee comes into the picture. It is like money in the wallet, but a digital one, on the blockchain. For people with little experience with cryptocurrencies, Digital Rupee is like the Ether you store in your Ethereum wallet.

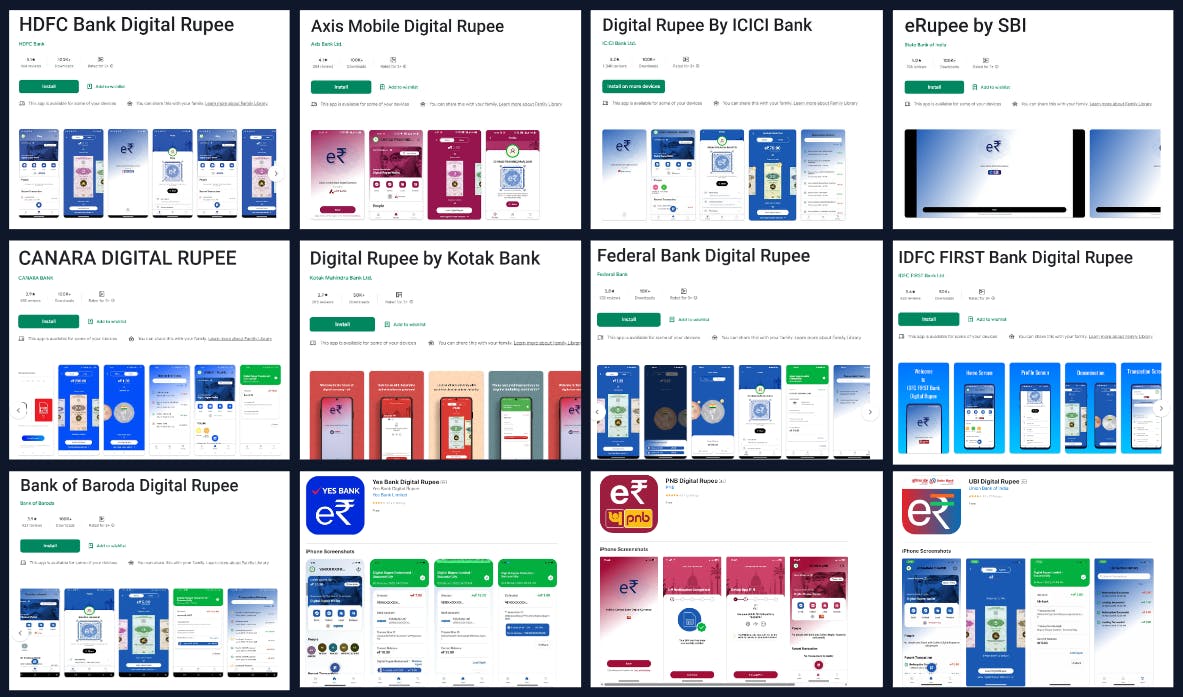

The digital rupee is the digital sibling of the physical Indian Rupee cash issued and backed by the Reserve Bank of India (RBI). All your notes and coins can be easily converted into a digital rupee. These can be done using government-approved crypto wallets on the Google Play Store or Apple App Store.

Looking at the screenshots of all these apps, it seems like all the banks are using a standardized app provided by the RBI. All look almost similar, with little customization to the color schemes and branding.

During the early stages, the Digital Rupee could only be used on an Android device, but iOS device apps have also been released. I, however, believe that various customized hardware wallets may enter the market once they are out of CUG. Only selected banks have been authorized to provide a digital wallet to users for transactions. I am unsure if there are plans for the government to provide access to third-party entities so that they can build their own applications over this infrastructure.

For the pilot program, the RBI had given access to four banks in the first phase, including State Bank of India (SBI), ICICI Bank, Yes Bank, and IDFC First Bank, while Bank of Baroda, Union Bank of India, HDFC Bank, and Kotak Mahindra Bank joined in the second phase. Punjab National Bank, Canara Bank, Federal Bank, Axis Bank and IndusInd Bank joined soon after that.

“The results of both the pilots so far have been satisfactory and in line with expectations”

-The Reserve Bank of India

What's changing?

When you make a transaction using any current systems (like NEFT, RTGS, or IMPS), they need to be settled by the banks. The government provides these settlement services through the government counterparty called The Clearing Corporation of India Limited or CCIL. This institution is necessary to avoid discrepancies in the money market and fend off clashes between the financial institutions in the country. This is a time-consuming and resource-hungry process. What Digital Currency brings to the table is the fast processing of these settlements through the blockchain's ledger system. In the current system, only the participating banks know about the transactions, but with CBDC, the ledger is visible to all so that anyone can verify the data.

Another point that needs to be understood is that the Digital Rupee, unlike the fiat currency, is the liability of the Reserve Bank and not the commercial bank.

The government is planning to release two types of CBDCs. The first one is the CBDC-R (retail) which would be used for retail settlements, i.e. for general users like you and me. In contrast, the CBDC-W (Wholesale) would be focused on settlements within financial institutions.

Does CBDC mean more cash?

With the digital rupee, there is no physical money association. To understand this, let's take an example. Let's say there are ₹30 lakhs(3 million) worth of banknotes in an institution, which needs to be converted to a digital alternative. You can either convert it to digital cash or convert it to a CBDC.

Converting to digital cash: If you convert the banknotes to digital money, you just create a digital identity for all those ₹30 lakhs notes. If you are familiar with Linux OS, these digital cash are something like Symlinks. Whatever happens to these digital cash happens to the physical ones. If you send ₹10 lakhs to Singapore, you send the cash too.

Converting to digital rupee: If you are converting the cash to digital rupee, you'll have to destroy all the physical cash and mint new digital rupees if you are the RBI or exchange the cash with existing digital rupees worth ₹30 lakhs.

The digital rupee introduction does not mean there will be more cash in the country or that a parallel currency will be in existence. It will co-exist with the already present rupee ecosystem.

What are the benefits of CBDC?

There are certain benefits to using this type of currency. These are a few of them:

It could increase financial inclusion by enabling users to use an alternative payment option for individuals who may not have access to traditional financial services.

Cost reduction is one of the motivations for adopting the digital rupee. As discussed earlier, the settlement process of the current financial infrastructure is tedious and expensive. The printing, storage, transportation and replacement of banknotes are a hit on the taxpayers' money.

CBDC ensures enhanced security. Your currencies are secured in a crypto-wallet which only you can access. You can increase the security of your wallet by adding two-factor authentication. This way, even if your device is lost, you don't have to worry about your money going anywhere.

CBDC can also potentially be used offline, thus removing dependency on network stability for transactions.

It can prevent counterfeiting and ensure the integrity of transactions.

It can provide better traceability and transparency in financial transactions, which could help mitigate financial crimes.

Are there any disadvantages to CBDC?

There are several potential disadvantages to implementing a CBDC:

Implementing CBDC requires the setup of significant technical infrastructure.

With increased traceability and transparency, many privacy concerns arise, which would make citizens hesitant to adopt CBDC.

Many would not want to shift to using CBDC without familiarity with the technology.

Central banks may lose some control over the money supply and financial system if many transactions shift to a CBDC. They can track the movement, but they cannot take the money.

Digital currencies, including CBDCs, are vulnerable to cyber attacks, which could compromise the security and integrity of the currency.

Frequently Asked Questions

How is Digital Rupee different from UPI?

It is like comparing a ₹10 note with NEFT. UPI is a system that allows the transfer of money between parties, but Digital Rupee is like cash but digital. If UPI is ever made for Digital rupees, you will transfer your digital rupees to others using UPI.

How is Digital Rupee different from Cryptocurrency?

Unlike cryptocurrencies, which are commodities, the Digital Rupee can be considered a Fungible Token (not an NFT). Cryptocurrencies like Ether, XPR, and Bitcoin are all on a public ledger (chain) and can be bought or sold by anyone. These cryptocurrencies have no issuers. Digital Rupee is based on a private, permissioned blockchain that is limited to users allowed by the chain's owner; in this case, it is the Government of India.

Blockchain technologies are known to be secure and anonymous. How do they avert illegal activities?

Digital Rupee is controlled by banks (powered by), so if you want to exchange your rupees for digital rupee, you will have to go to banks. If you wish to exchange your digital rupee and get physical cash, you will have to go to the banks. In one way, you will have to go to the banks to either buy your way in or out through banks that the RBI highly monitors and everything on the platform is also monitored. So, the probability of illegal activities on this platform is very low.

Does this mean banks are going away?

Well, no. The Indian government has authorized the banks to distribute these tokens. Like it or not, banks are still going to be there. You will still need the banks if you want to earn interest by depositing your money or if you want to apply for a loan. All traditional bank functionalities will still be there.

Why would I want to use Digital Rupee over UPI?

Remember when your last UPI transaction was stuck, and you were left with an ice cream in your hand and the shopkeeper staring at your face? You try again, but your internet is not working, and you have to ask someone for their hotspot. Or have you double-paid someone accidentally? This issue is solved by the digital rupee, as the transactions are instantaneous. When you pay someone through UPI, both your and the receiver's bank are working in the background to resolve the payment request. That is what causes the delay in your transactions. However, with Digital Rupee, no intermediaries are involved, so transactions are lightning-fast.